By Liu Zhiqiang, People’s Daily

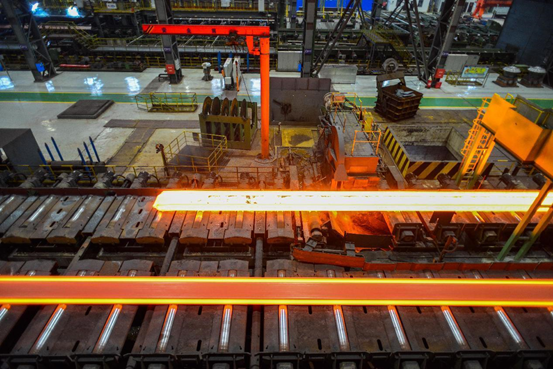

After a series of manufacturing procedures, coils of steel strips are turned into high-strength steel foil of different sizes at a factory of Shanxi Taigang Stainless Steel Precision Strip Co., Ltd., a subsidiary of Chinese steelmaker China Baowu.

Then the company’s flagship product, an extremely thin stainless steel foil, which is known as “hand-torn steel” as it can be easily ripped by hand, rolls off the production line and enters into aerospace, high-end electronics, new energy, and other fields.

“Last year, the production and sales volume of our hand-torn steel tripled those in 2020. Our operating revenue grew by over 30 percent, and profits also nearly tripled,” said Wang Tianxiang, a manager of the company.

In the past, Chinese companies could not produce “hand-torn steel” and had to import it at a price of one million yuan ($150,286) per ton; after the company developed “hand-torn steel”, the price of it was immediately cut by half, and the supply cycle was shortened from half a year to one month, according to Wang.

China is able to produce various kinds of iron and steel products, from “hand-torn steel” that is as thin as 0.015 millimeters and nib steel with its machining precision thinner than a human hair to large-scale steel structure support columns and axles of high-speed electric multiple units (EMUs).

“China has established an iron and steel industrial system with the most complete industrial chain and largest scale in the world. It is equipped with the most advanced equipment, processes, and technologies for iron and steel production, and can provide rich and diversified iron and steel products,” pointed out He Wenbo, executive chairman of the China Iron and Steel Association (CISA).

China’s steel output exceeded 100 million tons and became the world’s largest steel-producing country in 1996. Since then, the country has ranked first in the world in terms of both iron and steel production and consumption for 26 years in a row.

Last year, the country’s steel production reached 1.035 billion tons, accounting for 53 percent of the world’s total, making it remain the world’s largest iron and steel producer.

Meanwhile, China’s iron and steel industry has also gradually embarked on a new development path driven by innovation and characterized by intelligent manufacturing and green and low-carbon development.

In recent years, many Chinese iron and steel companies have promoted the integrated application of new-generation information technology in industrial scenarios by leveraging big data, artificial intelligence (AI) and industrial Internet, and other cutting-edge technologies, effectively improving production efficiency and operating profit.

While automatic steel-making, remote operation, and maintenance, and industrial robots have greatly facilitated steel production, Chinese steelmakers such as Baowu, Shagang Group, and NISCO have built “dark factories” and intelligent workshops, achieving round-the-clock operations that require less or no manual labor.

At present, the numerical control rate of key processes in the metallurgical industry of China has reached 66 percent. Digital transformation has also greatly reduced the costs of iron-making and steel-making processes for iron and steel enterprises.

China’s goals of peaking carbon dioxide emissions before 2030 and achieving carbon neutrality before 2060 are promoting the fundamental reform of the iron and steel industry’s development model.

By utilizing more than 130 advanced environmental protection technologies such as desulfurization and denitrification, iron and steel companies have realized full purification of flue gas and efficient treatment of pollutants. Meanwhile, they have fully exploited steel scoria to remove sulfur dioxide from exhaust gases and built fully enclosed corridors and medium pipelines to minimize the environmental impact of coke, iron ore powder, etc.

By the end of 2021, 34 companies in the iron and steel industry had made announcements of the completion of transformation oriented toward ultra-low emission, which involved a steel production capacity of about 225 million tons.

Statistics from the CISA showed that the average comprehensive energy consumption per ton of steel in China’s key iron and steel enterprises in 2021 dropped to 550.43 kilograms of standard coal, from 602.71 kilograms of standard coal in 2012, which signified a narrower gap between the country’s iron and steel industry and the advanced level in the world.

The iron and steel enterprises’ emissions of sulfur dioxide, as well as smoke and dust per ton of steel, decreased by 81.41 percent and 63.44 percent, respectively.

By 2025, the proportion of electric-arc furnace (EAF) steel output in total crude steel output is expected to increase to more than 15 percent, according to the CISA.

In February, the Ministry of Industry and Information Technology, together with other authorities, issued a guideline on promoting the high-quality development of the iron and steel industry, specifying the development goals and paths for the industry for some time to come.

In the future, China’s iron and steel industry will continue to steadily march forward on the road of high-quality development to better meet the needs of economic development.