By Xu Peiyu, People’s Daily

A technology company headquartered in Suzhou city, east China’s Jiangsu province, lately rolled out a platform for the application of the country’s digital fiat currency, or the e-CNY, through which it achieved integrated management of its corporate wallet and realized interbank salary payment to employees. The practice has made the company the first of its kind in China that has successfully piloted e-CNY interbank salary payment to employees.

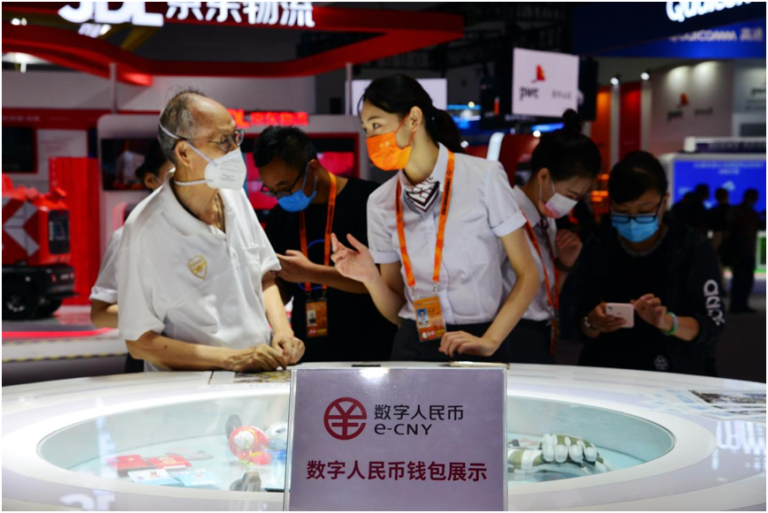

As the research, development as well as pilot use of e-CNY is steadily advanced in China, digital renminbi is increasingly recognized and welcomed by the public.

On April 2, the People’s Bank of China (PBOC), the country’s central bank, announced that it would expand the digital yuan pilot program to more Chinese cities in an orderly manner. According to the PBOC, e-CNY will be made accessible in Tianjin and Chongqing municipalities, Guangzhou city in south China’s Guangdong province, Fuzhou and Xiamen cities in east China’s Fujian province, and six cities in east China’s Zhejiang province that will hostand co-host the 2022 Asian Games.

Recently, Beijing and Zhangjiakou city in north China’s Hebei province were included into the program after tests in the 2022 Olympic and Paralympic Winter Games.

Starting from the end of 2019, the PBOC carried out trials of digital renminbi in Chinese cities including Shenzhen, Suzhou and Chengdu, Xiong’an New Area in Hebei, as well as application scenarios of the Beijing 2022 Winter Olympic and Paralympic Games. In November 2020, it added six more pilot areas, including Shanghai, to the trials.

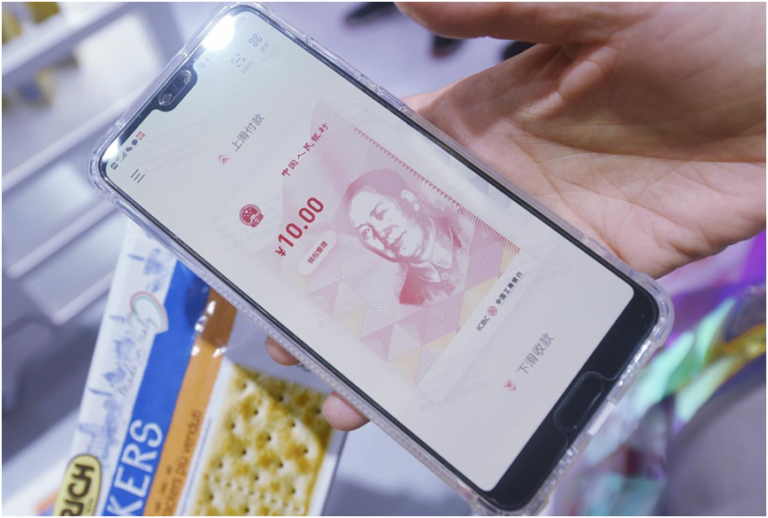

Data released by the PBOC showed that as of the end of 2021, the number of pilot scenarios for digital renminbi had exceeded 8.08 million; a total of 261 million personal wallets for digital yuan had been opened; and digital yuan transactions in China amounted to over 87.5 billion yuan ($13.76 billion).

The recent inclusion of more cities into the digital renminbi pilot program is expected to only help carry out pilot use of e-CNY on a larger scale and conduct in-depth test on the performance of the digital renminbi system, but allow more users to enjoy the convenience of e-CNY in advance of its official application nationwide.

Since last year, the construction of digital yuan payment scenarios has gathered pace. In particular, during the Beijing Winter Olympics, the digital renminbi pilot project covered more than 400,000 scenarios in seven key fields including catering, housing, transportation, traveling, shopping, entertainment, and health care.

In January, a channel for e-CNY payment was opened for all the offline consumption scenarios of Meituan, China’s leading service-focused e-commerce platform, which was the first time that digital renminbi has covered all scenarios of local life services.

So far, digital renminbi has formed a number of online and offline application models in wholesale and retail, catering, cultural tourism and payment for government affairs, which can be replicated and promoted in other fields. Major pilot projects, such as those at the scenarios of the 2022 Olympic and Paralympic Winter Games, have been implemented successfully and received positive response from the market; and the numbers of users, merchants and transactions involved in the pilot projects have grown steadily.

The PBOC emphasized the importance of marketization and law-based development of e-CNY in the next stage of its work.

During the development, promotion and popularization of e-CNY, policy design should fully stimulate the enthusiasm and creativity of financial institutions, technology companies, local governments and other parties, and encourage competition in the promotion of e-CNY application, it pointed out.

The PBOC also believes it necessary to prospectively improve the legal system to ensure the safety of the digital renminbi system, handle the relationship between privacy protection and crime prevention well, and conduct in-depth research on the potential impact of e-CNY on the financial system and other aspects.

It also underlined that it would stick to a two-tier operation structure, with the central bank being the upper tier and commercial banks forming the lower tier, to give full play to the advantages of designated commercial banks, and intensify efforts to promote pilot use and the construction of an ecosystem for digital renminbi.

It called on efforts to ensure that digital renminbin plays a greater role in expanding the coverage of financial services, improving inclusive financial services, boosting local economic development, supporting the construction of digital government service platforms, raising the quality and efficiency of financial services for the real economy and optimizing business environment.